The development and planning of the long-proposed Alaska LNG project was handed over to a private partner last week after the Alaska Gasline Development Corporation’s board of directors approved a final contract.

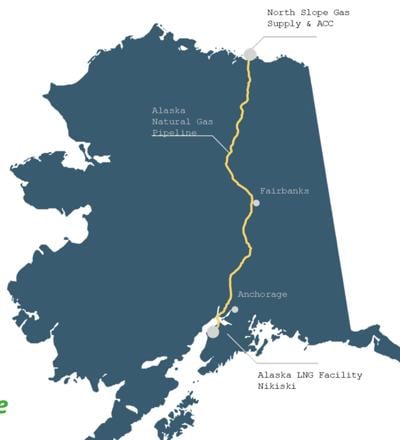

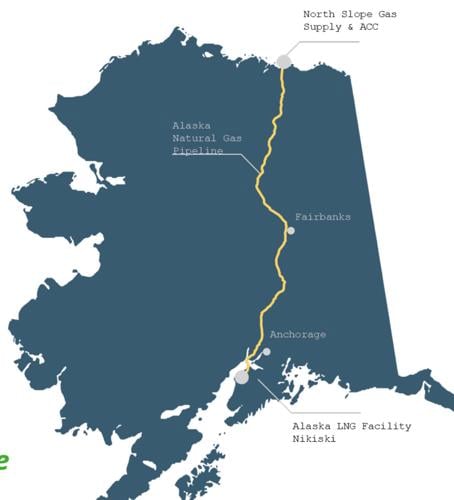

The New York-based Glenfarne Group will lead efforts on a front-end engineering design (FEED) for the $44-billion project. It will start with a roughly 750-mile in-state pipeline from the North Slope to Anchorage. Later, other components, including a North Slope carbon capture plant and an export hub in Nikiksi, will be included.

“Glenfarne’s financial, project management, and commercial expertise is well matched to lead this vital project forward,” Glenfarne CEO and founder Bredan Duval said Thursday. “Alaska LNG will provide desperately needed energy security and natural gas cost savings for Alaskans and give Glenfarne unmatched flexibility to simultaneously serve LNG markets in both Asia and Europe through our three LNG projects.”

ADGC President Frank Richards originally announced that Glenfarne took an interest in a framework agreement earlier this year. While he originally declined to name the company, the Alaska Landmine broke the news the next day.

“Alaska LNG will ensure a brighter future for generations of Alaskans, and I look forward to working with Glenfarne as they lead Alaska LNG forward,” Richards said on Thursday.

Gov. Mike Dunleavy said the announcement was a historic mile mark for a project that has struggled for years to find a funding source to push it forward. The Alaska LNG project stalled in 2016 after its three largest backers, including ExxonMobil, ConocoPhillips and British Petroleum, pulled out and left ADGC to shepherd its advancement alone.

“This project has morphed over the years,” Dunleavy said. “We’ve got all of our permits and rights-of-ways and all the court cases so far have been resolved in our favor.”

Dunleavy added the project “is moving closer and closer to becoming an actual pipeline.”

The in-state pipeline FEED study would cost up to $50 million, while the entire project FEED would cost $150 million.

If Glenfarne decides to make a final investment decision, it would also lead to development, construction, and operation. It would take a 75% interest ownership in AGDC’s 8 Star Alaska, ADGC’s project development subsidiary.

The project has received renewed interest, including from Asian markets that might become key investors or customers. President Donald Trump has touted the project as a key example of “unleashing Alaska’s energy potential,” and included it in his Jan. 20 slew of executive orders.

Dunleavy and Richards called in from Tokoyo during Thursday, where Dunleavy was on an overseas trip to market the Alaska LNG pipeline, including Japan, Taiwan, Thailand and South Korea.

Japan and South Korea have expressed noncommittal interest in the project, while Taiwan’s state-owned energy firm CPC Corp signed a nonbinding letter of agreement to buy LNG from Alaska and invest in the project.

“I don’t think we’ve been closer to the confirmation of a [gas] pipeline in our history,” Dunleavy said. “A lot of us believe this could lead to a pipeline being build in the next two-and-a-half years that will bring gas to Alaskans and our military bases.”

Duval, Glenfarne’s CEO, said his company will cover the engineering and design costs required to determine a final investment decision. Duval said the money will come from an array of private investors; however, a federal loan guarantee secured by Sens. Lisa Murkowski and Dan Sullivan through congressional legislation could help support the project.

“Hopefully, we can start delivering LNG in 2030 or 2031,” Duval said.

Duval hasn’t mentioned whether investors would be able to provide funding to construct the project. The entire Alaska LNG project has an estimated price tag of $44 billion, while the in-state line would cost at least $11 billion.

While Glenfarne will assume the complete FEED costs, the Alaska Industrial Development Export Authority (AIDEA) will provide a $50 million line of credit as a backstop. If Glenfarne completed the in-state line study but decided not to invest, AIDEA would pay the costs associated with the FEED and AGDC would take ownership of the documents.

As of Friday, AGDC had not finalized any negotiations with AIDEA on the backstop funding.

During Thursday’s press announcement, Duval said Glenfarne would proceed without the backstop funding agreement in place.

Sourcing the natural gas remains unclear as well. ADGC signed a deal with Great Bear Pantheon, a small oil and gas explorer, to provide natural gas at a bargain. But the deal hinges on whether Great Bear makes a final investment decision on its oil field near the North Slope.

Richards, ADGC’s president, said the state agency is working with other North Slope gas producers to secure sources from Point Thomson and Prudhoe Bay.

Richards added that the in-state pipeline will prioritize benefiting Alaska Railbelt utilities, which face a dwindling supply from accessible Cook Inlet reservoirs. Hilcorp, the largest Cook Inlet producer, told utilities in 2022 that it could not provide new contracts given the uncertainty of the gas supply.

“Ultimately, this would be the construction of a pipeline and full operation of a full LNG pipeline that would allow us to liberate and commercialize those North Slope stranded assets,” Richards said.

This left utilities, including Enstar and Chugach Electrical Association, to start exploring import options, which could drive up energy costs for Alaskans.

A few state lawmakers remain skeptical about selecting Glenfarne as the lead agency.

Sen. Jesse Bjorkman (R-Nikiski) voiced his concerns during ADGC’s board meeting on Thursday. The board had exited executive session after voting on the contract and opened up to public comment.

Bjorkman said Alaskans had “many questions” about the deal and stressed that Alaska and the U.S. will get the most benefit from the megaproject.

“People may wonder now for decades or generations about what other opportunities might be or may have been foregone by decisions made here today,” Bjorkman said. “Certainly you all had received communication that there were others who would like to present the board with offers and opportunities, but that has not happened as of yet, and I think it’s prudent to do that, considering the generational impacts that the decisions made are going to have on on all of Alaskans.”

ADGC has been looking for several partners for years. In 2023, it hired Goldman Sachs to find investors and interested parties to finance the project.

On Friday, ADGC spokesperson Tom Fitzpatrick noted in a written statement that after the Glenfarne contract was finalized, other parties stepped forward with interest in the project.”

On Friday, Sen. Kelly Merrick (R-Eagle River) also expressed concerns on a social media post. Merrick said Richards should have examined all options before signing a deal with Glenfarne.

“This is a complete abdication of his duty to Alaska,” she wrote.

Other issues, such as a Fairbanks spur line, are also up in the air. The roughly 40-mile spur line would connect to the main line running down across the Parks Highway and connect to a hub in Fairbanks near the University of Alaska Fairbanks.

However, Richards has maintained the Fairbanks line is a separate project with its own permitting and right-of-way requirements. Rep. Will Stapp (R-Fairbanks) introduced legislation in late February that would have required ADGC to append the spur line to the overall project, but Richards said that would require re-opening the Alaska LNG project’s federal permitting process.

At Thursday’s board meeting, Richards told the board that there is a private entity willing to invest in the estimated $187 million project; AGDC would assist with permitting and right-of-way updates and allow both projects to be constructed in tandem. However, he did not name the private company, citing that it wishes to remain anonymous for now.